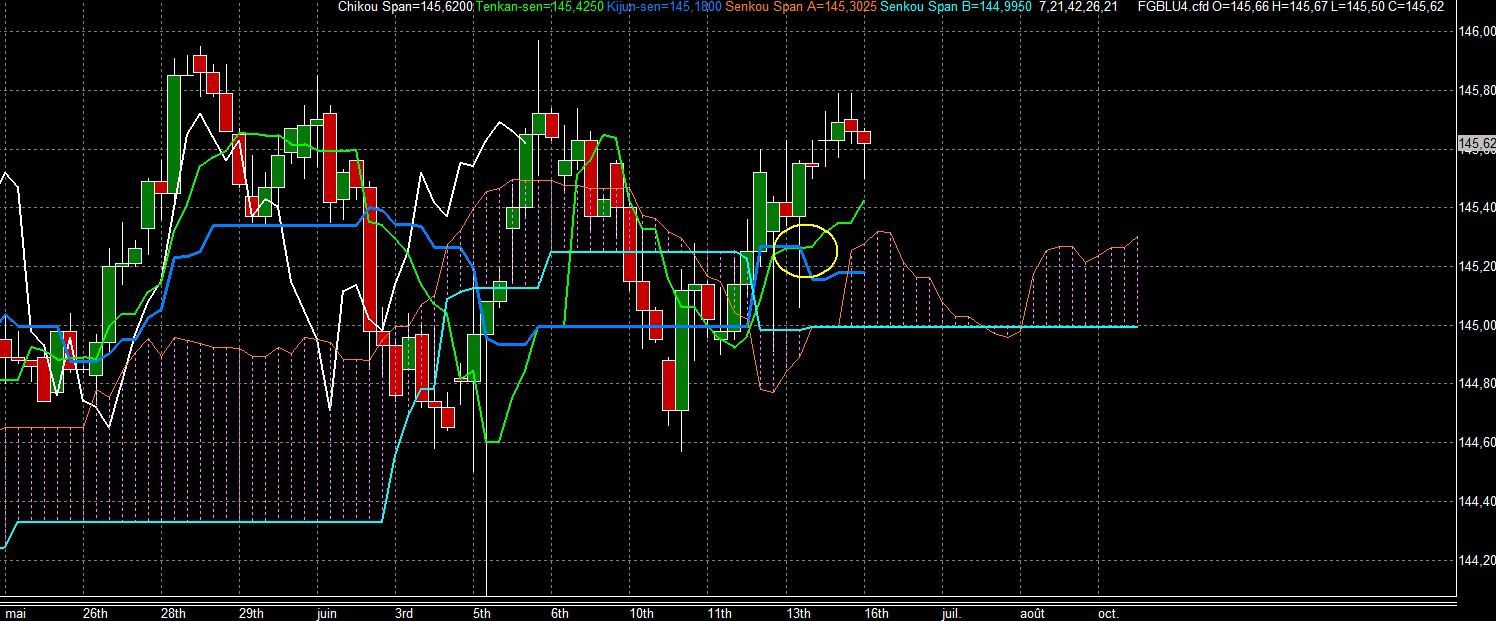

TOP OF THE RANGE AND REVERSE ?

Market opened where it closed on Friday and traded all day in a tiny range to end broadly where it opened.

At 145.68, POC is 25 ticks above Friday's POC. Volume is very small.

Prices are in contact with upper BB. MA 44 and 23 are flat, fast stochastics are topping. I would not be surprised to see prices going down again, towards lower BB (144.75 this evening).

On the resistance side, there is HoD (145.81) the 145.97-99 (HoY and R1) then mid R1-R2 (146.20) and R2 (146.45).

On the support side, below LoD (145.55) there is PP (145.31) then the 145.06-90 area (mid PP-S1, 2x LoD and SSB) and finally S1(144.78).

Tomorrow at 11 am there is the ZEW and in the afternoon some important US statistics).

I may be keen seller below today's LoD (145.55) with a stop above HoD (145.81) to target lower BB (144.75) which is to say S1.

Good Night.

/image%2F0867158%2Fob_c72fbc_mars1small-2065f7e.gif)

/image%2F0867158%2F20140621%2Fob_222627_bund-jour-jpg)

/image%2F0867158%2F20140619%2Fob_e0a56d_bund-jour-jpg)

/image%2F0867158%2F20140618%2Fob_f05505_bund-ichimoku-jpg)

/image%2F0867158%2F20140617%2Fob_c20a29_bund-jour-jpg)